Choosing a Payment Gateway in Singapore: A Complete Guide [2025]

Discover the best payment gateway in Singapore for your business. Our complete guide explores fees, features, local payment methods, and seamless integration.

Discover the best payment gateway in Singapore for your business. Our complete guide explores fees, features, local payment methods, and seamless integration.

Think of a payment gateway as the digital version of a credit card machine you see in a physical shop. It’s the essential technology that connects your online store to payment networks like Visa and local favourites like PayNow. When a customer clicks “buy,” the gateway securely handles the whole process, making sure the money gets from their account to yours.

Let’s break that down with a practical example. When your customer types in their card details, the gateway’s first job is to encrypt this sensitive information. It then securely sends it over to the payment processor.

This all happens in a few seconds, giving your customers that smooth, trustworthy checkout experience they expect. For any business selling online in Singapore—from a direct-to-consumer brand to a multi-vendor marketplace—this system is the engine that drives your revenue. You simply can’t accept online payments without one.

The massive shift to online shopping has turned choosing the right payment gateway in Singapore into a crucial business decision. This one choice affects everything from customer happiness to how efficiently your business runs. We’ve all been there—a slow or confusing payment page is the fastest way to abandon a cart.

This is especially true in Singapore’s thriving digital economy. The payments scene is booming, thanks to everyone jumping into e-commerce. The market is valued at a staggering USD 23.53 billion as of 2025 and is set to climb to USD 37.28 billion by 2030, growing at a healthy 9.63% each year.

A payment gateway does more than just move money. It protects customer data, fights fraud, and makes sure you get paid without any drama. It’s a cornerstone of your online business.

Picking a gateway involves more than just finding the cheapest transaction fees. You should find a partner that helps you grow. For instance, if you’re planning to sell to customers overseas, you’ll need a gateway that handles different currencies without any issues. A local marketplace seller, on the other hand, needs one that connects directly into platforms like Shopee or Lazada.

Here’s why this decision is so important for your business:

At the end of the day, your gateway is the final link between your hard work and your revenue. Understanding how it all works is the first step to building a powerful online sales machine, something we dive deep into when building a high-performing e-commerce website in Singapore.

If you want to win over shoppers in Singapore, you must offer the payment methods they already use every day. Simply accepting credit cards isn’t enough anymore. A solid payment gateway in Singapore will provide the full range of local favourites, from digital wallets to the incredibly popular PayNow QR system.

Offering familiar options at checkout does more than just close a sale; it builds instant trust. When a customer sees their go-to payment method, like GrabPay or their bank’s app, it removes a major point of hesitation. It’s a clear signal that your business understands the local market, a small detail that can significantly reduce cart abandonment rates.

The payment habits here are diverse and change fast. While credit cards are still widely used, the explosion of e-wallets and instant bank transfers has completely changed what customers expect at the checkout screen.

Payment gateways are the engine behind Singapore’s e-commerce boom. The market for Payment Service Providers is set to hit USD 46.20 million by 2025, growing at a blistering 12.9% CAGR. While cards are still projected to make up 75% of online sales by 2028, digital wallets are the top choice in 2024. This just shows how critical it is to support multiple payment types. You can dive deeper into Singapore’s payment market trends to see its impressive growth in the region.

Let’s break down the must-haves for your store:

Actionable Insight: Integrating PayNow is a smart move for your cash flow. Card payments can take days to settle, but PayNow transactions often hit your bank account almost instantly. That means you get access to your money right away, which is crucial for managing inventory and marketing expenses.

Dealing with regulations can feel like a headache, but Singapore’s Payment Services Act (PSA) is there to make things safer for everyone. The Monetary Authority of Singapore (MAS) oversees it, setting the rules for payment providers, including the gateway you end up choosing.

Here’s the most important takeaway for you as a business owner: always choose a PSA-licensed provider. This licence is your guarantee that the gateway meets tough standards for security, consumer protection, and how they run their business. It means your money and your customers’ data are being handled correctly.

Working with a licensed payment gateway is a strategic move that builds customer trust. When shoppers see you’re using a regulated and well-known payment partner, they feel much safer hitting that ‘buy’ button.

Here’s what a PSA licence guarantees:

At the end of the day, picking a PSA-licensed payment gateway in Singapore is a mark of a professional operation. It shows your customers you take their security seriously—and that’s key to building a loyal following and a lasting business.

Picking the right payment gateway in Singapore is a huge decision for your online business. Think of it like choosing the perfect location for a physical shop—it has to be reliable, secure, and above all, easy for your customers to use. Your choice here directly impacts your sales, your day-to-day operations, and even your ability to grow internationally.

Forget the glossy sales pitches for a moment. You need a solid framework to properly weigh your options. This involves more than hunting for the lowest transaction fee; it’s about understanding the total cost, how quickly you get paid, and what tools you’ll have to fight off fraud.

Let’s break down what really matters.

The headline transaction fee is designed to grab your attention, but it rarely tells the whole story. What looks cheap on the surface can quickly become expensive once you add up all the other charges hiding in the fine print.

To get a real sense of the cost, you need to dig into these details:

Actionable Insight: Create a simple spreadsheet to compare providers. Make a column for each fee type and plug in your average monthly transaction numbers and sales volume. For example, if you process 200 orders at an average of S$50 each, you can calculate the total fees for a provider charging 3.4% + S$0.50 versus one charging a flat S$99 monthly fee plus 2.9% + S$0.30. This simple exercise will cut through the marketing fluff and show you the true cost.

To help you organise your thoughts, here’s a quick-reference table to guide your evaluation process. Think of it as a checklist to ensure you’re asking the right questions as you compare different payment gateways.

| Evaluation Criteria | What to Look For | Why It Matters for Your Business |

|---|---|---|

| Fee Structure | The complete cost: transaction fees, monthly fees, setup charges, and hidden costs like chargeback penalties. | A low headline rate can be misleading. Understanding the total cost is essential for protecting your profit margins. |

| Settlement Speed | How quickly funds are transferred to your bank account (T+1, T+3, etc.). | Faster settlement means better cash flow, which is critical for managing inventory, marketing, and other operational expenses. |

| Multi-Currency Support | Ability to display prices in and accept payments from various international currencies. | A must-have if you plan to sell overseas. It reduces friction for international customers and boosts conversion rates. |

| Security & Fraud Tools | Robust features like 3D Secure (3DS), AVS, CVV checks, and AI-powered fraud detection. | Strong security protects your revenue from fraudulent transactions and costly chargebacks, building trust with customers. |

| API & Developer Docs | Clear, comprehensive, and well-supported API documentation. | Crucial for custom websites and marketplaces. A good API allows for seamless integration and custom payment experiences. |

| Marketplace Features | Support for split payments, automated payouts to multiple sellers, and individual seller onboarding. | Non-negotiable for marketplace businesses. These features are essential for managing complex financial flows between sellers and the platform. |

By systematically going through these criteria, you can move beyond a surface-level comparison and find a partner that truly fits your business model and growth ambitions.

Here’s a question every business owner should ask: “How quickly does my money actually show up in my bank account?” This is known as the settlement period, and it can make or break your cash flow. Some gateways settle in as little as one business day (T+1), while others can take a week or more. For a small business juggling inventory and marketing costs, faster access to your funds is a game-changer.

If you have any plans to sell outside of Singapore, multi-currency support is completely non-negotiable. A good gateway lets you show prices in a customer’s local currency and smoothly accept payments from international cards. This simple feature makes global shoppers feel right at home, cutting down on checkout friction and giving your conversion rates a serious boost.

When evaluating payment gateways, always compare the total cost of ownership including transaction fees, monthly charges, and any hidden costs that might affect your margins.

Your payment gateway is your first line of defence against the constant threat of online fraud. A single bad transaction can cost you more than just the sale amount—it comes with a painful chargeback fee and a headache you don’t need. Your provider absolutely must offer strong tools to protect your business.

At a minimum, look for these security essentials:

If you’re using a standard e-commerce platform like Shopify or WooCommerce, a simple plugin might be all you need to get started. But for businesses with custom-built sites or more complex models like a marketplace, the quality of the gateway’s Application Programming Interface (API) is everything.

A flexible, well-documented API is what allows your developers to build a truly seamless, on-brand checkout experience. It’s what makes custom payment flows, split payments for marketplaces, and deep integrations with your accounting software possible. Before you sign any contract, have your tech team review the provider’s developer documentation. They need to confirm it’s clear, comprehensive, and actively supported.

Picking a payment gateway in Singapore can feel like navigating a hawker centre at lunchtime – a dizzying mix of international giants and local heroes are all vying for your attention. There’s no single “best” provider for everyone. The right choice really comes down to your business model, how tech-savvy you are, and where you plan to take your business.

A tech-heavy startup, for example, might gravitate towards a provider known for a powerful, well-documented API that allows for heavy customisation. On the other hand, a small business owner on Shopify just needs something simple to set up, with clear pricing and solid support for local favourites like PayNow.

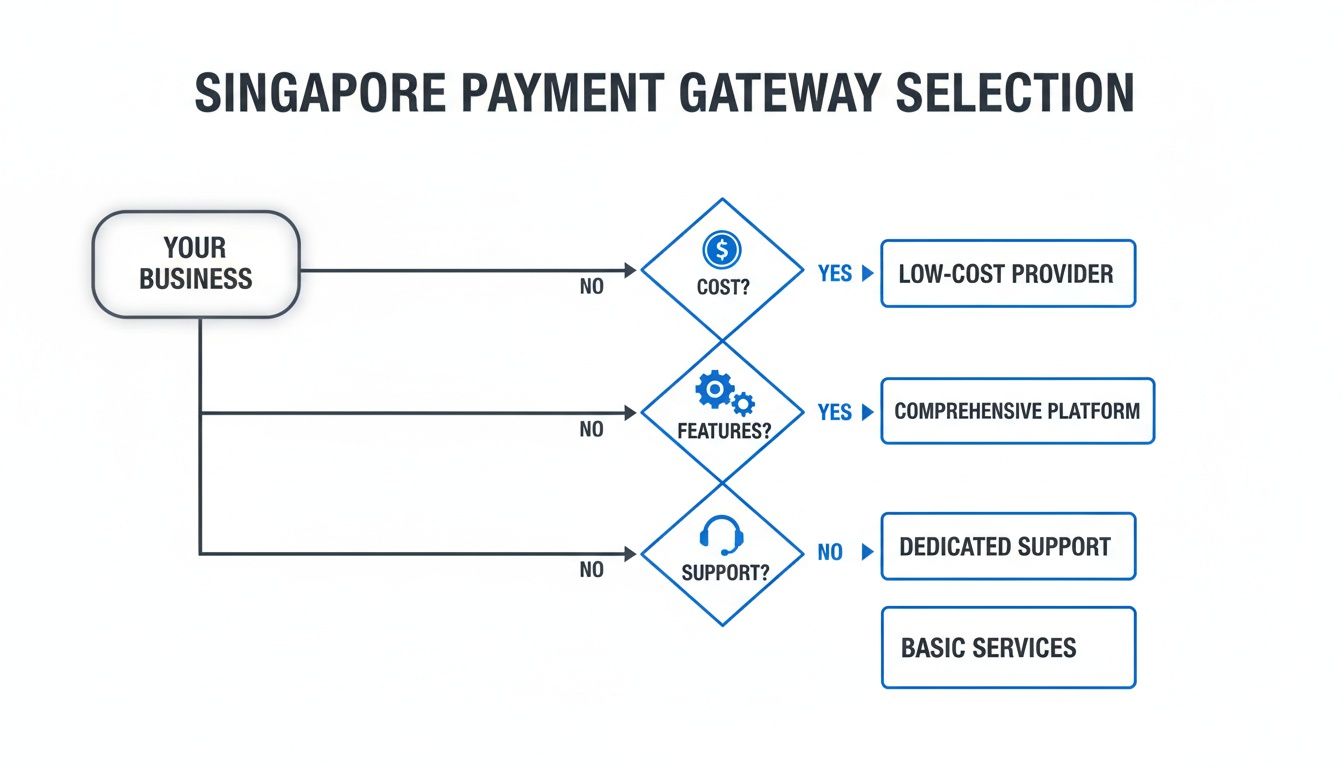

This decision tree gives you a simple visual guide to help match your business priorities—whether that’s keeping costs down, getting your hands on advanced features, or just knowing you have reliable support—to the right type of gateway.

As the chart shows, the sweet spot is where your specific needs for cost, features, and support all meet. Let’s take a look at some of the top players in the game.

The big international payment companies usually come with a reputation for rock-solid tech, extensive developer tools, and top-notch security. They’re a natural fit for businesses with global ambitions or complex technical needs.

Stripe is a perfect example. It’s a huge favourite among developers and tech-first companies because of its powerful and flexible API. If you’re building a custom platform or a marketplace, Stripe is often the go-to choice for its ability to handle complicated payment flows, like split payments and subscriptions, with relative ease. Its global footprint also makes it a fantastic option if you’re planning to sell to customers all over the world.

The trade-off for all this power, though, can be a slightly more complex fee structure and a setup process that’s a bit more involved than some of the plug-and-play options.

This is where the local and regional providers really shine – they have a deep, ground-level understanding of the Singaporean market. They excel at offering smooth integration with the payment methods local shoppers actually use every day, like PayNow, GrabPay, and various bank transfer options.

HitPay is a popular Singapore-based gateway that’s all about making things simple and accessible for small and medium-sized enterprises (SMEs). It offers straightforward pricing, no-code payment links, and dead-simple plugins for popular e-commerce platforms like Shopify and WooCommerce. This makes it a fantastic choice for businesses that want to get up and running fast without needing a whole dev team.

Their laser focus on local payment methods is a massive plus for any business primarily serving the domestic market.

A key advantage of local providers is their hyper-focus on Singapore-specific payment habits. They often offer more competitive rates for PayNow transactions and provide dedicated local support that understands the nuances of the market.

To help you organise your research, we’ve put together a quick comparison below. If you want to go even deeper, be sure to check out our complete list of payment gateways in Singapore.

Here’s a quick look at some of the leading providers, comparing what they do best and the payment methods they support, giving you a starting point for your own research.

| Provider | Best For | Key Local Payment Methods | Typical Fee Structure |

|---|---|---|---|

| Stripe | Tech-focused businesses, marketplaces, and global sellers needing a powerful API. | Credit/Debit Cards, PayNow, GrabPay, AliPay | Percentage + fixed fee per transaction (e.g., 3.4% + S$0.50). |

| HitPay | SMEs, social sellers, and businesses wanting a simple setup with strong local payment support. | PayNow, GrabPay, Credit/Debit Cards, DBS PayLah! | Lower fees for PayNow; standard percentage for cards. No setup or monthly fees. |

| eGHL | Established businesses and enterprises looking for a wide reach across Southeast Asia. | Extensive regional bank transfers, e-wallets, and cards. | Custom pricing is often based on volume and specific business needs. |

| 2C2P | Airlines, hotels, and large enterprises with complex, high-volume payment needs in Asia. | Comprehensive support for regional cards, wallets, and over-the-counter payments. | Enterprise-level custom pricing; may include setup and monthly fees. |

Ultimately, the best approach is to shortlist two or three providers that feel like a good match for your core needs. From there, you can dive deeper into their documentation, pricing models, and support reviews. This focused comparison will help you find a partner that can grow with your business for the long haul.

Once you’ve picked the right payment gateway in Singapore, the next hurdle is getting it connected to your store so you can actually start taking money. The process can feel a bit technical, but most modern gateways have made it surprisingly straightforward.

The key is to follow a clear plan to avoid any nasty surprises when you finally flick the switch to ’live’.

To make this easier, we’ve broken it down into two separate checklists. One is for direct-to-consumer (DTC) brands using platforms like Shopify, and the other is for sellers operating within a marketplace. Each path is a little different.

If you’re running your own e-commerce store, integration is usually handled through plugins or dedicated apps. This makes connecting your chosen payment gateway much simpler than trying to build something from scratch.

Here’s a clear, step-by-step guide to get you up and running:

Actionable Insight: Before you announce your launch to the world, place a real order for a small amount yourself using a personal credit card. This final check confirms that money is being captured correctly and the entire process is smooth, from checkout right through to the order confirmation page.

For sellers on platforms like Shopee, Lazada, or Amazon, the process is completely different. You don’t need to integrate a gateway at all because the marketplace already handles all the payments.

Instead, your job is to connect your business and bank details to their system so you can actually get paid.

Managing the operational side of an online business in Singapore requires careful planning, and getting a handle on these payout schedules is a big part of that.

Finally, no matter your business model, always let your customers know about any changes. If you’re adding new payment options like PayNow or GrabPay, announce it with a simple website banner or a social media post. It’s a small effort that can seriously improve the customer experience and maybe even boost your conversions.

When your business starts picking up steam, your payment strategy has to grow with it. Having a way to accept money isn’t enough anymore. You need a system that helps you expand, makes your daily operations smoother, and gives you a crystal-clear picture of your finances.

A big part of this is realising the power you have as your sales volume climbs. The more transactions you process, the more leverage you have with your payment gateway. Don’t be shy about asking for better rates.

For example, if you’re consistently processing over S$50,000 a month, you’re in a great position to contact your provider’s sales team and discuss your fees. Knocking your rate down from 3.4% to 2.9% might sound small, but that can easily add up to thousands of dollars in savings a year—money that goes straight to your bottom line.

Let’s be honest, manual reconciliation is a nightmare for any growing business. Trying to match up thousands of individual transactions from your gateway’s report with your bank statements is a slow, mind-numbing task that’s just begging for human error.

This is where automation becomes essential. Modern payment gateways offer detailed reports and often link up directly with accounting software like Xero or QuickBooks. Getting this connection set up is a game-changer.

Your payment gateway in Singapore is more than just a tool for processing transactions; it’s a treasure trove of customer data. The analytics dashboard can tell you a lot more than just how much you sold—it reveals how your customers are buying.

Practical Example: By digging into your transaction data, you can spot all sorts of patterns. You might discover that 70% of your sales between 8 PM and 10 PM come from mobile devices using GrabPay. This insight is pure gold. It tells you to double-check your mobile checkout flow for GrabPay users and perhaps run targeted ads to that audience during those peak hours.

This is where unified commerce platforms like OneCart can take things to the next level. By pulling together sales data from all your channels—be it Shopee, Lazada, or your own Shopify store—and merging it with your payment gateway’s info, you get a single, powerful view of your entire business.

As you build out your payment infrastructure, it’s also smart to look at how other digital industries are beefing up security. For instance, a biometric-first approach to fraud reduction shows where advanced security is heading. Adopting this forward-thinking mindset ensures your payment system supports your growth, rather than holding it back.

When you’re sorting out payment gateways, a few questions always seem to pop up. Here are some straightforward answers to the most common queries from business owners in Singapore.

The time it takes to get your payment gateway approved in Singapore can really vary. For simple platforms designed for small businesses, you could be up and running in just one to three business days, assuming you have all your documents like your ACRA registration ready to go.

However, if you’re working with larger providers or are in what’s considered a higher-risk industry, expect it to take a bit longer. Their Know Your Business (KYB) checks are a lot more detailed, so the process might stretch out to one or even two weeks. The best way to speed things up is to double-check that your application is complete and all your documents are clear right from the start.

Yes, you definitely can. Using a global payment gateway like Stripe for your Singapore-based business is very common. These platforms are popular for good reason: they offer powerful technology, great tools for developers, and handle multiple currencies without a fuss, which is a must if you plan on selling to customers beyond Singapore.

The most important thing to check is that the international gateway has a solid local setup. This means they need to fully support Singapore Dollars (SGD) and, critically, integrate with local payment methods like PayNow and GrabPay. If they don’t, you risk losing a huge chunk of local customers who expect to see these options when they check out.

It helps to think about it with an analogy.

The payment gateway is like the secure digital cashier at the front of your online store. It’s the part the customer interacts with. The payment processor is the behind-the-scenes workhorse that talks to the banks to actually get the money moved over.

So, the gateway is the customer-facing technology. It’s the digital version of a credit card terminal in a physical shop, securely grabbing and encrypting payment details from your checkout page.

The processor, on the other hand, does the heavy lifting in the background. It takes that encrypted info from the gateway and communicates with the customer’s bank and your bank (think Visa and DBS) to get the transaction approved and move the funds. Thankfully, most modern providers bundle both services into one neat package.

Integrating PayNow through your payment gateway makes the whole process incredibly smooth for everyone. When your customer gets to the checkout and picks PayNow, the gateway springs into action. It instantly generates a unique QR code or shows your PayNow VPA (Virtual Payment Address).

Your customer simply scans that QR code with their banking app, and the payment is authorised on the spot. Your gateway detects the successful payment in real-time and automatically updates the order to “paid” in your e-commerce system. This completely gets rid of the need to manually check bank transfers, making the process fast, efficient, and free of errors.

Ready to stop juggling multiple sales channels and get a single, clear view of your entire e-commerce operation? OneCart centralises your orders, inventory, and listings from Shopee, Lazada, TikTok Shop, Shopify, and more into one powerful dashboard. Learn how OneCart can help you scale faster.

Automate & Scale Your Online Business with OneCart

Start a Free TrialUsed by hundreds of merchants in Singapore & Southeast Asia