A Complete List of Payment Gateways in Singapore [2025]

Explore our complete list of payment gateways in Singapore. We compare fees, features, and integrations to help your business find the perfect solution.

Explore our complete list of payment gateways in Singapore. We compare fees, features, and integrations to help your business find the perfect solution.

Finding the right payment gateway in Singapore is a critical decision for any online business. You have global giants like Stripe and PayPal, alongside strong regional players like HitPay and 2C2P. Each one offers different features, and your choice will impact everything from your transaction fees to the checkout experience you provide to your customers.

When reviewing the list of payment gateways in Singapore, think about your specific business needs. A new online store has different requirements than a large enterprise processing thousands of transactions daily. The best solution must match your sales volume, technical setup, and customer base.

The digital payments scene here is growing rapidly. Singapore’s payments market is projected to reach USD 23.53 billion in 2025 and is expected to grow to USD 37.28 billion by 2030. This growth is driven by a massive increase in e-commerce, making your payment gateway the foundation of your online operations. You can find more details on this trend by exploring insights into Singapore’s booming payments market.

To simplify your choice, let’s break it down into a few core factors:

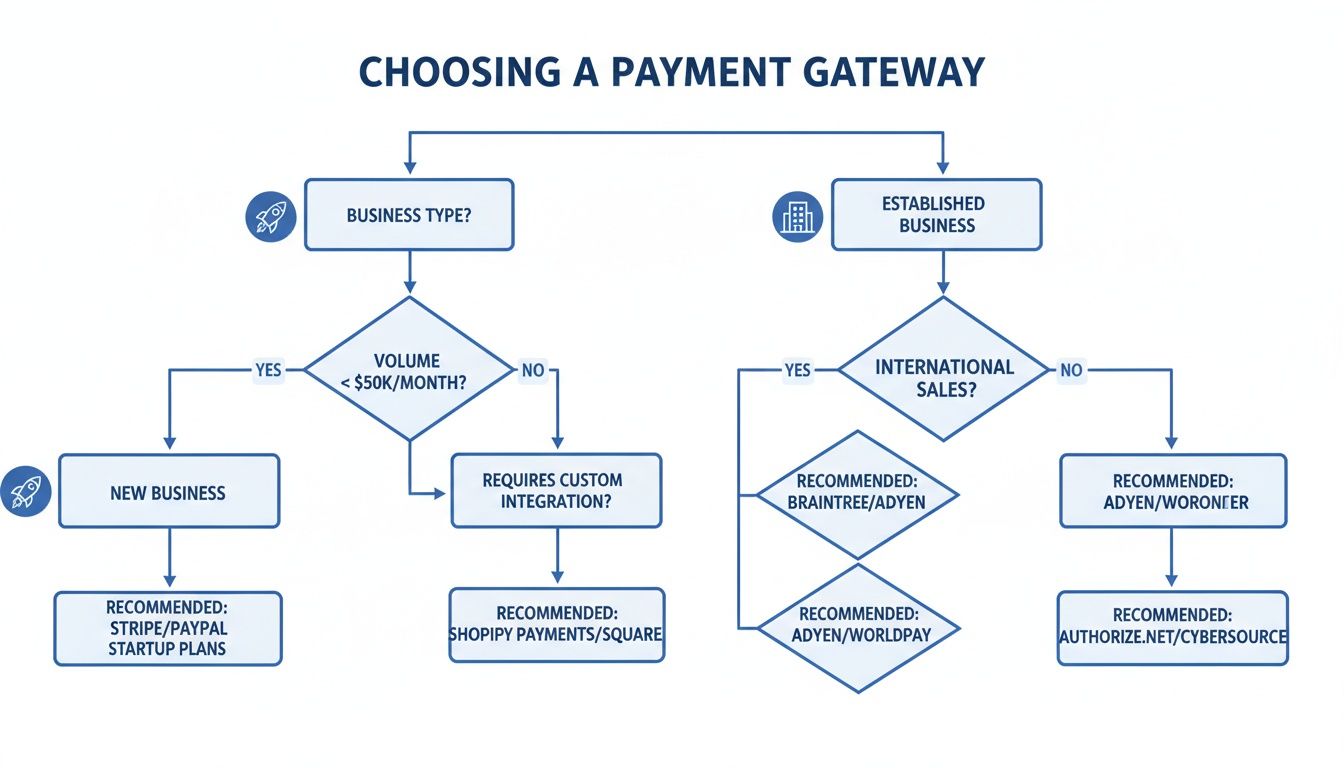

This decision tree infographic can help you visualize the best path forward, depending on whether you’re just starting out or already established.

As the flowchart shows, new businesses should prioritize low setup costs and easy integration. Established businesses should focus more on scalability, robust security, and offering a wide variety of payment options.

To give you a head start, we’ve put together a quick-reference table. This is designed to help you quickly compare some of the leading payment gateways at a glance, focusing on who they’re best for, the payment methods they support, and their typical pricing.

| Gateway | Best For | Key Payment Methods | Typical Pricing Model |

|---|---|---|---|

| Stripe | Tech-savvy businesses, startups, global sellers | Credit/Debit Cards, PayNow, GrabPay, Apple Pay, Google Pay | Pay-as-you-go, blended rate per transaction |

| PayPal | Businesses needing brand trust, freelancers, international sales | PayPal balance, Credit/Debit Cards | Pay-as-you-go, percentage + fixed fee per transaction |

| HitPay | SMEs, multi-channel sellers, businesses wanting all-in-one tools | PayNow QR, Credit/Debit Cards, GrabPay, WeChat Pay, AliPay | Pay-per-transaction, no monthly fees, optional POS software subscription |

| 2C2P | Large enterprises, airlines, travel, businesses needing regional reach | Credit/Debit Cards, local bank transfers, regional e-wallets | Custom pricing, often involves setup and monthly fees |

| Adyen | Enterprises, omnichannel retailers, large global corporations | Extensive global and local methods, including cards, wallets, bank transfers | Interchange++ pricing, custom monthly fees |

This table is a starting point. Each gateway offers more features, but this should help you narrow down your options before diving into the details.

Choosing the right payment gateway requires more than just finding the lowest headline rate. You must find a partner that helps you grow, keeps costs manageable, and gives your Singaporean customers a smooth checkout. A poor choice will affect your cash flow and daily operations.

First, you need to understand the true cost of every transaction. A low percentage fee can look appealing but often hides other charges. It’s crucial to break down the entire pricing model before you sign anything.

Payment gateway fees are rarely a single number. The most common structure is a percentage of the sale plus a fixed fee. You must calculate how this structure affects your business, especially based on your average order value (AOV).

Let’s use a typical fee structure like 3.4% + S$0.50 to see how it works for two different businesses:

This example shows how flat-rate models can be costly for businesses with smaller transaction sizes. Also, look for other costs in the fine print, such as setup fees, monthly account charges, or penalties for chargebacks.

Actionable Insight: Always model the total cost using your own sales data. Before committing, ask any potential provider for a complete fee schedule. This is the only way to avoid surprises and ensure the pricing works with your profit margins.

Your customers in Singapore expect payment choices. If you limit those options at checkout, you increase the chances of cart abandonment. A good payment gateway needs to accept more than just standard credit and debit cards.

Here are the local payment methods you should look for:

Offering these localized methods helps prevent lost sales. It also shows you understand the Singaporean market, which builds trust and can increase your revenue.

“Settlement time” refers to how long it takes for the money from a customer’s purchase to arrive in your bank account. This can range from one business day to over a week and has a significant impact on your cash flow.

A gateway that offers T+2 settlement means money from a Monday sale will be in your account by Wednesday. In contrast, a provider with a T+7 schedule can create a major lag, tying up your working capital for a full week. For a small business, that kind of delay can make it difficult to pay suppliers or restock inventory. Always get the payout schedule in writing before you sign up.

When you look beyond Singapore to attract international customers, partnering with a globally recognized payment gateway is a wise move. These major international players offer robust infrastructure, powerful developer tools, and a brand name that builds instant trust with buyers worldwide. This section focuses on the global giants that have a strong local presence in Singapore.

These platforms are known for their scalability and deep feature sets, making them a popular choice for startups and large enterprises. They provide the tools to accept local payments and expand confidently into cross-border e-commerce.

For tech-savvy businesses and startups needing deep customization, Stripe is often the first choice. Its well-documented and powerful APIs allow you to build a tailored checkout experience, recurring billing systems, and handle complex payment flows.

Stripe excels at making complicated processes simple. For example, a local Software-as-a-Service (SaaS) startup can use Stripe’s API to build a subscription model that automatically manages monthly charges, handles different pricing tiers, and follows up on failed payments. This allows the startup to focus on developing its product instead of managing payment logistics.

Stripe supports a wide range of payment methods essential for the Singapore market:

This screenshot from Stripe’s Singapore homepage shows their focus on being a single, unified platform for various payment needs.

As you can see, Stripe presents itself as a full-stack financial infrastructure platform for businesses of any size, not just a payment processor.

Its standard pricing is a straightforward pay-as-you-go model, typically around 3.4% + S$0.50 for each successful card transaction. There are no setup or monthly fees, making it accessible for new businesses, while they also offer custom pricing for merchants with high transaction volumes.

PayPal is one of the most recognized payment brands in the world. If you’re a Singaporean e-commerce store selling to customers in the US or Europe, adding a PayPal button at checkout can significantly boost your conversion rates. This is because millions of international shoppers already have a PayPal account and trust its security.

Its main strengths are its simplicity and global reach. For instance, a freelance graphic designer in Singapore can send a PayPal invoice to a client in Australia in minutes. The client can pay instantly with their PayPal balance or a linked card, and the money appears in the designer’s account almost immediately.

PayPal’s Seller Protection program is a significant advantage. It adds a layer of security against fraudulent chargebacks and claims, providing comfort when dealing with unfamiliar international buyers. This helps reduce the risk of selling globally.

Setting it up on major e-commerce platforms like Shopify or WooCommerce is simple. For merchants selling across borders, understanding different market nuances is key. To learn more, check out our guide on navigating cross-border e-commerce challenges for practical insights.

Adyen is designed for large, established enterprises that need a single, unified platform to handle payments across all channels: online, in-app, and in physical stores. It is a powerful solution for major retailers with a presence on Orchard Road and a thriving e-commerce site.

Consider a large fashion retailer with boutiques across the island and a busy online shop. Adyen allows them to consolidate all their payment data into one system. This enables true omnichannel strategies, like “buy online, return in-store,” to work seamlessly because the transaction data is consistent and accessible everywhere.

Adyen uses a pricing model called Interchange++, which is more complex but can be more cost-effective for businesses with high volumes. It breaks the cost into three transparent parts: the interchange fee (which goes to the customer’s bank), the card scheme fee (to Visa/Mastercard), and Adyen’s processing fee. This transparency allows large merchants to see exactly what they’re paying for. While powerful, its complexity and pricing make it less suitable for smaller businesses.

While global giants are solid choices, the advantages of local and regional payment gateways should not be overlooked. These providers have a deep understanding of the Southeast Asian market. They are attuned to the specific preferences of shoppers in Singapore and across the region, which often translates to better features and payment methods for your business.

Providers like HitPay, 2C2P, and iPay88 excel in this area. They are proficient at supporting local e-wallets and bank transfer systems that are popular across ASEAN. Integrating these familiar payment options can significantly boost your conversion rates, especially if you plan to sell beyond Singapore into markets like Malaysia, Indonesia, and Thailand.

HitPay has become a popular choice for Singaporean SMEs because it bundles everything a multi-channel seller needs into one package. You get online payment processing combined with a powerful Point of Sale (POS) system, creating a unified setup for businesses that sell both online and in-person.

Its main strength is its excellent support for local payment methods. For example, a local café using HitPay’s POS can instantly generate a dynamic PayNow QR code for a customer’s order at the counter. It’s fast, cashless, and uses a system Singaporeans already know and trust, making the checkout process smoother.

HitPay is designed to be accessible. It offers straightforward, pay-per-transaction pricing with no setup or monthly fees. This makes it an excellent starting point for new businesses and SMEs who need a robust solution without a long-term commitment.

For larger businesses aiming to expand into Southeast Asia, 2C2P is a strong contender. Founded in 2003, it has built an impressive payment network that covers the entire region. They specialize in complex industries like airlines, travel, and large-scale retail that require sophisticated cross-border payment capabilities.

The main attraction is its extensive list of country-specific payment methods. For instance, if you’re a Singapore-based online retailer expanding into Thailand, 2C2P allows you to seamlessly accept payments via popular Thai options like TrueMoney Wallet or local bank transfers. This localized experience is crucial for building trust and securing sales in new territories.

2C2P is packed with enterprise-grade features, including:

Given its enterprise focus, 2C2P’s pricing is usually customized based on transaction volume and specific business needs, so expect setup and monthly fees.

Originating from Malaysia, iPay88 is another well-established regional player with a significant presence in Singapore. It is particularly strong in facilitating online banking transfers and supports a wide variety of payment options popular in both Malaysia and Singapore.

This makes iPay88 a smart choice for businesses with many customers in both countries. For example, an e-commerce store selling to Malaysian shoppers can use iPay88 to easily accept payments through Malaysian online banking systems like Maybank2u or CIMB Clicks. This removes a major point of friction for those customers.

Actionable Insight: When choosing a regional gateway, examine its strengths in the specific markets you want to enter. A provider with deep ties to the Malaysian banking network is invaluable if that’s your next move, while another might be better connected in Indonesia.

This strategic focus on regional payment habits is essential. The Singaporean market illustrates this trend; in 2024, digital payment penetration here reached 57%, the highest in Southeast Asia. This growth benefits gateways that support local preferences, where credit cards still led e-commerce with 71% of transactions in 2023. You can explore more about this digital shift by reviewing Singapore’s e-commerce payment trends. For businesses evaluating various providers, exploring resources like Paytia’s network of payment gateway partners can offer valuable insights into available choices.

The headline transaction rate for a payment gateway is just the beginning. That prominent number, like 3.4% + S$0.50, doesn’t tell the whole story. To understand what you’ll actually be paying, you must investigate all the other costs that contribute to the total price.

Many businesses are surprised by extra charges that were not initially obvious. These can significantly reduce your profits, especially as your sales volume increases. It is crucial to look beyond the basic per-transaction fee and get a clear picture of the entire fee schedule.

Beyond the standard processing fee, various other charges can appear on your monthly bill. When comparing payment gateways in Singapore, you need to ask about these specific costs to get an accurate understanding.

Keep an eye out for these common extra fees:

Failing to account for these costs is a common mistake. A gateway with a low transaction rate can become more expensive than an all-in-one option once you add up all the monthly fees and other penalties. Always run the numbers based on your own sales projections.

Let’s make this practical. Imagine a small e-commerce store in Singapore with S$10,000 in monthly revenue from 200 separate sales (an average of S$50 per order). This example shows how different pricing models can affect your bottom line.

When evaluating your options, getting a full picture with a detailed payment processing fees comparison is key to making a smart decision.

Here’s a quick breakdown of what that might look like.

This table illustrates the total estimated monthly cost for a small business across different payment gateway pricing models, including transaction, monthly, and other potential fees.

| Gateway Example | Pricing Model | Transaction Fees | Monthly Fee | Total Estimated Cost |

|---|---|---|---|---|

| Gateway A | Pay-as-you-go | S$10,000 x 3.4% + (200 x S$0.50) = S$440 | S$0 | S$440 |

| Gateway B | Subscription-based | S$10,000 x 2.9% + (200 x S$0.50) = S$390 | S$30 | S$420 |

| Gateway C | High-volume custom | S$10,000 x 2.5% + (200 x S$0.30) = S$310 | S$50 | S$360 |

As you can see, the gateway with the lowest transaction rate (Gateway C) is not always the cheapest initially because of its monthly fee. However, in this scenario, it turns out to be the most cost-effective option overall. For a deeper dive into how we handle payments, feel free to check out our billing and payments help section.

This is the kind of analysis you need to do. Plug your own sales figures into these calculations before you commit to a gateway. It’s the only way to be sure it’s the right fit for your business and your budget.

Connecting a payment gateway to your online store can seem like a major technical challenge, but it doesn’t have to be. For most businesses using popular platforms like Shopify or WooCommerce, the process is designed to be straightforward.

The key is to know what you’re looking for and understand the different integration methods. Your goal is a smooth checkout for your customers without needing a team of developers. A solid integration ensures that payments are processed reliably, which is crucial for building trust and securing revenue.

Most payment gateways in Singapore offer two main options for connecting to your store. The easiest is using plug-and-play apps or extensions. These are pre-built connectors that you install directly from your e-commerce platform’s marketplace, often in just a few clicks.

For example, if you’re on Shopify, you can search for “HitPay” or “Stripe” in the Shopify App Store, install their official app, and follow the on-screen instructions to link your gateway account. This method is ideal if you want a fast, reliable setup without dealing with code.

The second method involves using an Application Programming Interface (API). This is a more hands-on approach, typically used for custom-built websites or when you need specific payment features that an app cannot provide. An API is a set of rules and tools that allows your website to communicate directly with the payment gateway.

Actionable Insight: If you’re considering an API integration, always review the gateway’s developer documentation first. A provider like Stripe is known for its clear, comprehensive docs, complete with code examples and testing tools. This makes a significant difference for your development team and can save them time and frustration.

Before committing to any provider, you need to assess its technical fit for your business. A little research here will prevent major headaches later. For more specific advice, our detailed guides on platform integrations can provide extra clarity.

Use this quick checklist to ensure a gateway is right for you:

With the growth of online shopping, robust security is a fundamental requirement for any business in Singapore. Choosing a payment gateway with strong, built-in security and fraud prevention tools is essential. It is your first line of defense, protecting your revenue, reducing chargebacks, and earning your customers’ trust.

This focus on security is more critical than ever. In Singapore, scam losses are increasing. The median loss per case rose 36.4% to S$1,500 in the first half of 2025, and e-commerce fraud alone reached S$7.6 million. Gateways are enhancing their security, especially with MAS regulations in place. You can read more about regional payment methods and security trends to get the bigger picture.

Before diving into specific gateways, it is helpful to understand a few key security terms. These are the foundations of secure payment processing and are frequently mentioned.

Beyond basic standards, modern payment gateways provide customizable tools to actively combat fraud based on your business’s specific risks. This allows you to be proactive.

Here’s a practical tip: Use your gateway’s fraud rules to automatically flag or block transactions that fit high-risk patterns. For example, you could set a rule to manually review any order over S$500 that originates from a high-risk country. This can help prevent a potential chargeback before it occurs.

This hands-on approach puts you in control. You can create rules that flag transactions based on IP location, multiple failed payment attempts from the same card, or unusually large order sizes. This empowers you to protect your business without manually reviewing every single order.

Exploring Singapore’s payment gateway options often raises a few common questions for business owners. Let’s answer them to help you make a clearer decision.

Not always. Many of today’s leading providers, like Stripe and PayPal, operate as payment aggregators. This means they use their own master merchant account and set up your business as a sub-merchant.

The advantage for smaller businesses is significant. It eliminates the lengthy bank application process, allowing you to set up and start accepting payments quickly. A new startup, for example, could have a Stripe account live in minutes.

However, if you are processing a very high volume of sales, it might be beneficial to obtain a dedicated merchant account directly from a bank. When paired with a gateway, this can sometimes provide more competitive transaction rates.

Nearly every serious gateway in the Singapore market has integrated PayNow, as it has become an essential local payment method. The “best” one depends on your business setup.

The key is to consider your entire operation. Do you just need a simple online button, or a complete system that connects your digital and physical sales?

This is crucial for cash flow. The time it takes for money from a sale to reach your bank account is called the settlement time, and it can vary significantly between providers.

A shorter settlement time means you get your working capital back faster, allowing you to pay suppliers or reinvest in new stock without delay. Always get the payout schedule in writing before you commit.

Stripe, for example, typically operates on a rolling schedule, transferring funds to your Singapore bank account within 2-7 business days. PayPal is different; it allows you to keep a balance in your PayPal account and withdraw the funds manually whenever you need them.

Juggling payments and orders across Shopee, Lazada, and your own website can get messy. OneCart brings everything into one place, syncing your orders and inventory in real-time. This stops overselling in its tracks and makes your entire fulfilment process much smoother. Learn how OneCart can simplify your multi-channel e-commerce management.

Automate & Scale Your Online Business with OneCart

Start a Free TrialUsed by hundreds of merchants in Singapore & Southeast Asia