How Do You Calculate Margin for Smarter Ecommerce Pricing 2026

Learn how do you calculate margin with our guide. Get simple formulas, real-world examples, and actionable tips to boost your ecommerce profitability.

Learn how do you calculate margin with our guide. Get simple formulas, real-world examples, and actionable tips to boost your ecommerce profitability.

Calculating your profit margin is straightforward. Take your total revenue from a sale, subtract the direct cost of the product, divide that result by the revenue, and finally, multiply by 100 to get a percentage.

The formula, Margin = [(Revenue - COGS) / Revenue] * 100, reveals exactly what portion of every sale is pure profit.

It’s easy to focus on increasing revenue. While a growing top-line number is encouraging, it only provides a partial view of your business’s performance. Your profit margin is the true health indicator, showing how effectively you convert sales into actual cash.

A high revenue figure can mask underlying issues. If your costs are increasing unchecked, you might be left with very little profit despite all your sales efforts.

Understanding your financial health begins with robust small business accounting, which provides the foundation for any accurate margin calculation. For marketplace sellers, the primary challenge is to identify and track every single associated cost.

Before we go further, let’s clarify the key terms. This table serves as a quick reference as we analyze the numbers.

| Term | Simple Definition | What It Tells You |

|---|---|---|

| Revenue | The total amount of money you bring in from sales. | Your top-line sales performance before any costs are taken out. |

| COGS | All the direct costs of getting your product ready to sell. | The true cost of your inventory, not just the supplier price. |

| Gross Profit | The money left over after you subtract COGS from your Revenue. | The profit you make from selling your products, before other business expenses. |

| Margin | The percentage of revenue that is left after accounting for COGS. | The profitability of your products on a percentage basis. |

Consider these terms the essential components for understanding your store’s financial performance. Now, let’s focus on the most crucial one.

The “Cost of Goods Sold” (COGS) is a common point of confusion for many sellers. It includes much more than the price you paid your supplier. To calculate an accurate margin, your COGS must account for every direct cost related to acquiring the product and making it available for sale.

For an online seller, this typically includes:

Actionable Insight: A common mistake that inflates profit figures is forgetting to include costs like inbound shipping in your COGS. To maintain accuracy, every expense incurred to acquire and prepare your inventory for sale must be included in your calculations.

The average ecommerce store aims for a gross margin of around 45%. However, this figure can decrease significantly after accounting for all other business expenses.

After factoring in marketing, fulfillment, and platform fees, the average net profit margin often drops to just 10%. This highlights how quickly operational costs can reduce your actual take-home profit.

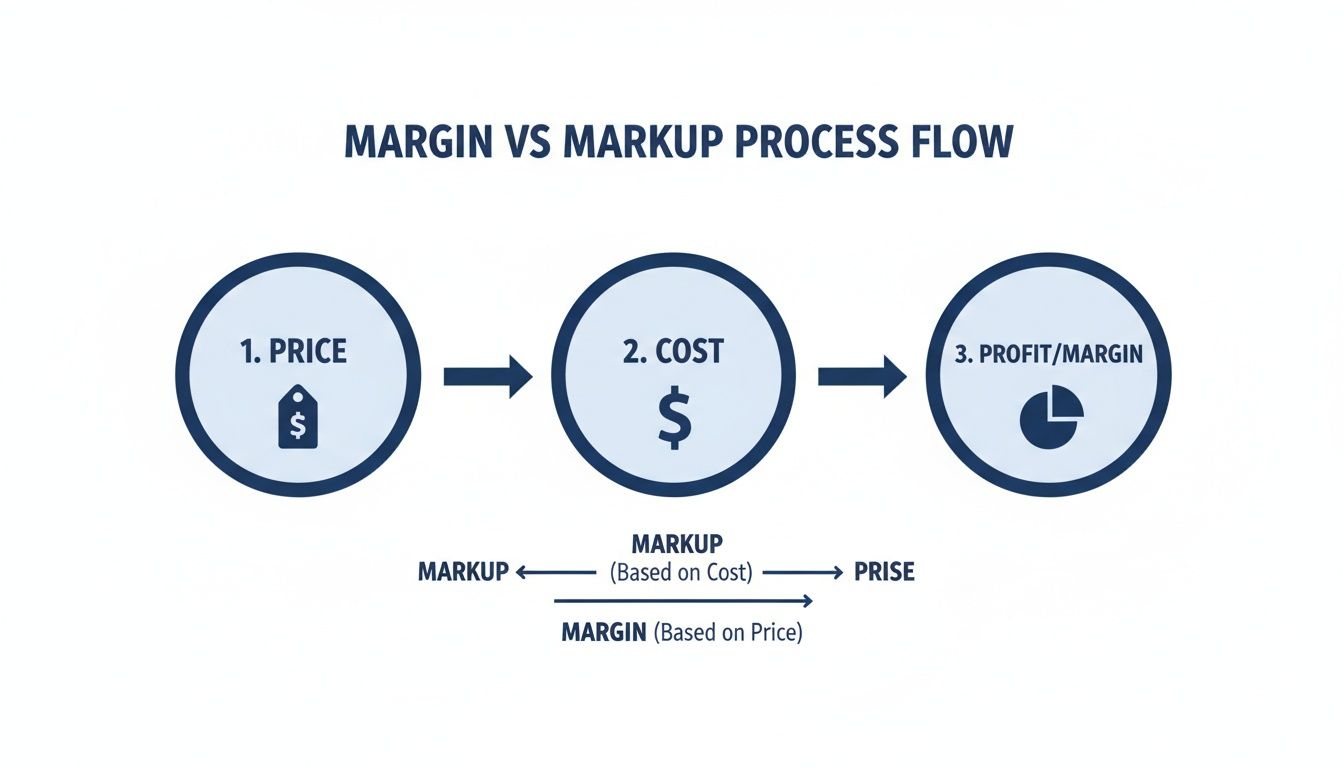

To fully understand your store’s profitability, you need to master two key calculations: gross margin and markup. Both use the same core numbers—your selling price and your costs—but they provide different perspectives on your business’s financial health.

Knowing how and when to use each formula is essential for effective financial management.

Gross margin expresses your profit as a percentage of the final selling price. It answers the question, “For every dollar of revenue I generate, what percentage is actual profit?” This is the most important metric for assessing the overall health and efficiency of your business.

Markup, conversely, shows profit as a percentage of your cost. It answers, “How much did I increase the price of this product from what I paid for it?” Sellers often use this metric when setting initial prices to ensure they have included a sufficient buffer to cover costs and achieve a specific profit target.

The formula for gross margin is simple and is always based on your revenue. It provides a clear view of your profitability on every sale.

Gross Margin (%) = [(Selling Price - Cost of Goods Sold) / Selling Price] x 100

This percentage shows exactly how much of every dollar earned is kept as gross profit. A higher margin indicates greater efficiency in converting revenue into profit, giving you more flexibility to cover other business expenses.

The markup formula is similar but uses your cost as the basis for the calculation. This makes it a useful tool for setting prices from the bottom up.

Markup (%) = [(Selling Price - Cost of Goods Sold) / Cost of Goods Sold] x 100

Markup is helpful when you know your costs and need to determine a selling price. However, relying solely on markup can be misleading. A 100% markup results in a 50% gross margin, not a 100% profit margin. Understanding this distinction is crucial, and we explore it further in our detailed guide on the differences between margin vs markup.

Let’s apply these formulas to a real-world scenario. Imagine you’re selling a pair of wireless earbuds on Shopee.

Now, let’s calculate both the margin and markup for this product.

Gross Margin Calculation:

Markup Calculation:

This example clearly illustrates the difference. While a 100% markup may seem impressive, the 50% gross margin is the accurate measure of your profitability. This 50% is the amount you have available to cover Shopee’s fees, marketing, shipping, and all other operational costs.

Selling a single product with a straightforward cost structure is one thing. For most online sellers, the reality is more complex.

When you manage stores on Shopee, Lazada, TikTok Shop, and your own Shopify site, the basic margin formula is insufficient. Each platform has its own fee structure, promotional tools, and shipping regulations that can quietly reduce your actual profit.

Knowing how to calculate your margin in this environment is essential. You must account for every variable cost associated with a sale on each specific channel. A product that appears profitable on one platform might actually be losing you money on another.

To gain a true understanding of your profitability, you need to look beyond the basic Cost of Goods Sold (COGS) and calculate your net margin. This involves subtracting all variable costs associated with making a sale.

These often include:

Let’s visualize how your selling price is reduced to your actual profit before we look at some real-world examples.

This flow demonstrates how various costs diminish your price, ultimately revealing your margin—the only figure that truly indicates whether you are making a profit.

Let’s see how this works in a practical scenario. Imagine you sell a high-quality water bottle on two different channels: your own Shopify store and the TikTok Shop.

Product Details:

Now, let’s break down the different fees that apply to each channel.

Scenario 1: Selling on TikTok Shop TikTok Shop is known for its aggressive promotions, but the fees can accumulate quickly.

Total Costs: $10 (COGS) + $8.10 (Fees) = $18.10 Net Profit: $30 - $18.10 = $11.90 Net Margin: ($11.90 / $30) * 100 = 39.6%

The impact of multiple costs often leads to margin compression in ecommerce. The industry’s rapid growth can obscure the fact that rising advertising costs and high return rates are shrinking profits, with average margins for some business models at just 10-15%.

Scenario 2: Selling on Your Shopify Store On your own platform, you have more control but also face a different set of costs.

Total Costs: $10 (COGS) + $5.67 (Fees) = $15.67 Net Profit: $30 - $15.67 = $14.33 Net Margin: ($14.33 / $30) * 100 = 47.7%

As you can see, the same product yields an 8.1% higher net margin on Shopify. Without tracking these channel-specific costs, you would have a dangerously incomplete view of your business’s financial health.

Attempting to do this manually for every SKU across multiple platforms is inefficient and prone to error. This is why a centralized dashboard is no longer a luxury—it’s essential.

Calculating your margin may seem simple, but a few common mistakes can provide a dangerously inaccurate picture of your store’s health. Getting this right is critical. Even small errors can lead to poor pricing decisions that compound over thousands of orders, gradually eroding your profits.

One of the most frequent errors sellers make is overlooking small but significant “hidden” costs. It’s easy to remember the supplier cost and marketplace commission, but other expenses can easily be missed. These are the real margin killers.

When you calculate your margin, every variable expense tied to a sale must be included. A few cents here and a dollar there can quickly add up to thousands over the course of a year. If you neglect these costs, the profit figure you see is not accurate.

Here are some of the most commonly missed expenses:

Actionable Insight: Create a master cost checklist for your products. List every conceivable expense, from the obvious supplier cost to the less obvious roll of packing tape. Make it a habit to review and update this list every quarter to ensure your margin calculations remain accurate as your costs change.

Another costly mistake is using the terms margin and markup interchangeably. They are not the same. As we covered earlier, they provide two different views of your profitability, and confusing them can lead you to underprice your products.

Remember our earbud example? A 100% markup sounds great, but it only translated to a 50% gross margin. If you priced your products believing a 100% markup meant that 100% of the sale price was profit, you would struggle to cover your basic operating expenses.

Markup is a tool for setting a price; margin is for understanding your actual profitability. It’s a critical distinction to master when deciding how to calculate your margin for strategic planning.

Once you are comfortable with accurately calculating your margins, the next step is to actively improve them. Boosting your profitability involves making a series of small, intelligent adjustments across your entire operation that accumulate over time.

Think of it as finding a few extra percentage points in different areas. A good place to start is your Cost of Goods Sold (COGS). Reducing even a small amount from your product acquisition costs can have a significant impact on your final profit.

Don’t hesitate to talk to your suppliers, especially as your order volume increases. Most are willing to offer better pricing for larger, more consistent orders. Frame the conversation as building a long-term partnership rather than just asking for a one-time discount.

Here are a few practical ways to approach this:

For most ecommerce sellers, shipping is one of the largest and most variable costs. A few grams can be the difference between shipping tiers, easily costing you an extra dollar or more on every package.

Conduct a thorough review of your packaging. Can you switch from a box to a lighter mailer? Can you reduce filler material without risking damage? These small adjustments reduce both shipping weight and packaging material costs, adding profit back to your bottom line.

Bundling is an excellent way to increase your average order value (AOV) while also clearing out slower-moving stock. The key is to pair a popular, high-margin product with a lower-margin or less popular item.

Practical Example: You could bundle a best-selling phone case (with a 60% margin) with a screen protector that has been sitting in inventory (with a 30% margin). This not only increases the perceived value for the customer but also helps you convert stagnant inventory back into cash.

The products you choose to sell also have a significant impact on your margin potential. Digital products and software often have gross margins of 70-90%, while beauty and cosmetics are typically in the 50-70% range. In contrast, consumer electronics and other commodity goods often operate with thin margins of just 15-25%. Knowing these benchmarks helps you set realistic targets.

Your prices should not be static. Monitor your competitors and adjust your prices dynamically. When demand is high or a competitor is out of stock, you may be able to increase your prices. During slower periods, a slight price drop can keep you competitive and maintain sales flow. This ensures you are not leaving money on the table.

To implement this effectively, you need a solid strategy. You can learn more by mastering dynamic pricing in ecommerce.

Improving operational efficiency is another powerful way to increase margins. Streamlining your pick-and-pack process or using automation can significantly reduce labor costs. It’s important to understand the real return on investment for any new technology. Every second saved and every error prevented contributes to a healthier bottom line.

To help you apply these ideas, we’ve created a simple checklist. Use it as a quick reference guide for identifying opportunities to improve profitability across your business.

| Strategy Area | Action Item | Potential Impact |

|---|---|---|

| Cost of Goods | Regularly renegotiate supplier terms based on volume. | High |

| Source alternative suppliers to ensure competitive pricing. | Medium | |

| Shipping & Packaging | Audit packaging to reduce weight and material costs. | High |

| Compare carrier rates at least quarterly. | Medium | |

| Pricing Strategy | Implement product bundles to increase average order value. | High |

| Use dynamic pricing tools to adjust to market conditions. | High | |

| Operational Efficiency | Automate repetitive tasks like inventory updates. | Medium |

| Optimize warehouse layout to speed up picking and packing. | Medium | |

| Marketing & Promotions | Analyze promotion ROI to cut underperforming discounts. | Medium |

| Focus ad spend on your highest-margin products. | High |

This checklist is not exhaustive, but it covers the core areas where sellers can make the biggest impact. Consistently reviewing these points can lead to significant, sustainable growth in your profit margins.

Once you understand the basic formulas, you will encounter real-world scenarios that are more complex. Correctly calculating your margin in these situations is key to making consistently profitable decisions.

Let’s address some of the most common questions sellers ask as they move from theory to daily practice. Mastering these details will ensure your numbers are always accurate, providing a true picture of your store’s financial health.

The answer depends heavily on your niche. There is no single magic number for success. A good margin in one category could be poor in another.

As a general guideline, a net profit margin between 10-20% is a healthy target for many online businesses. This typically provides enough cash to reinvest in growth, handle unexpected costs, and pay yourself.

However, industry specifics are crucial.

The most important action you can take is to research your specific market. Identify the industry average, and then track your own numbers against that benchmark.

Calculating the margin on a product bundle is straightforward, but you must be meticulous in summing up all your costs.

First, determine the total Cost of Goods Sold (COGS) for every item in the bundle. For instance, if you are creating a coffee lover’s kit with a mug (COGS $5), a bag of coffee beans (COGS $10), and a small milk frother (COGS $8), your total bundle COGS is $23 ($5 + $10 + $8).

Then, use the standard margin formula:

Margin = [(Bundle Selling Price - Total Bundle COGS) / Bundle Selling Price] * 100

If you sell this coffee bundle for $50, your margin would be: [($50 - $23) / $50] * 100 = 54%.

Remember to include any costs specific to the bundle itself, such as a special gift box, decorative filler, or the extra time required for assembly. Factoring in these small details is key to getting an accurate number.

Yes, a spreadsheet is an excellent starting point. It is accessible, affordable, and a great way to get organized when you are learning how to calculate margin. You can set up columns for SKU, Selling Price, COGS, Marketplace Fees, and Shipping, then use formulas to determine the margin on each sale.

However, as your business grows, this manual approach can become a significant bottleneck.

When you start selling across multiple channels—such as Shopee, Lazada, and TikTok Shop—the complexity increases dramatically. Each platform has its own fee structure. Manually entering data for hundreds of orders is not only time-consuming but also prone to human error. A single copy-paste mistake can skew your numbers for an entire month, leading to poor decisions based on inaccurate data.

This is the point where sellers often realize they need a more efficient system. A centralized platform that automates these calculations can save countless hours and eliminate costly errors, providing real-time, accurate margin analytics across all your stores in one place.

Manually calculating margins across Shopee, Lazada, and TikTok Shop is a recipe for errors and missed opportunities. OneCart automates this entire process, syncing your costs and sales data to give you a real-time, accurate view of your profitability on every single product and channel. Stop guessing and start making data-driven decisions by visiting https://www.getonecart.com to see how you can take control of your margins today.

Automate & Scale Your Online Business with OneCart

Start a Free TrialUsed by hundreds of merchants in Singapore & Southeast Asia