Your Guide to Ecommerce Cross Border Expansion [2025]

Unlock global growth with our complete guide to ecommerce cross border strategy. Learn logistics, payments, localization, and marketing to sell internationally.

Unlock global growth with our complete guide to ecommerce cross border strategy. Learn logistics, payments, localization, and marketing to sell internationally.

Cross-border e-commerce is the practice of selling your products online from your home country to customers in another. It’s the move that can turn your local shop into an international brand, unlocking a truly global customer base.

Imagine your local business is doing great, but you’re starting to hit a growth ceiling. You have a loyal following, but your home market is only so big. Cross-border selling opens a new door to a massive hall filled with potential buyers. It’s about strategically stepping into new markets to multiply your revenue streams and build a more resilient, worldwide brand.

To get this right, you need to go a step further than just shipping products to a new address. It requires understanding the e-commerce industry on a much deeper level. This knowledge helps you see beyond logistics and focus on the crucial details: market dynamics, shopper behaviour, and the operational muscle you’ll need to succeed.

How do you know when it’s the right time to make the leap? Look for clear signals that there’s unmet demand for your products from customers abroad. These signs tell you that there’s already an audience waiting for you to open your virtual doors to them.

Keep an eye out for these key indicators:

Practical Example: You run a boutique clothing brand in Australia. By checking your website analytics, you notice a surge in visitors from Singapore. If that traffic is paired with direct messages asking about shipping costs to the region, that’s a massive clue. Actionable Insight: Use this data to launch a targeted cross-border strategy focused on Singapore, as you have evidence of a profitable opportunity.

Picking the right entry point is crucial for a successful global launch. Mature, digitally-savvy markets offer a much smoother path for expansion. They typically have the right infrastructure and consumer habits that support online international shopping, which seriously lowers the friction for new sellers.

A strong digital infrastructure and a population comfortable with online shopping are foundational elements for successful cross-border expansion. These factors reduce the initial barriers to entry and accelerate market adoption for new brands.

Singapore is a perfect example of a market primed for cross-border e-commerce. The country has 5.79 million internet users out of a 6.03 million population—a staggering 96% penetration rate. The local e-commerce market is on track to hit USD 5.04 billion in 2024, and over 70% of shoppers there regularly buy from overseas.

This high level of digital maturity makes it an ideal first step for brands looking to expand into the wider Asian market.

Before you commit serious resources to a cross-border strategy, you need to be sure that Singapore is the right fit for your products. A hands-on, data-driven approach is what separates the winners from the rest.

This validation process is about building a solid business case. You want to base your expansion on genuine market demand, not just guesswork.

A fantastic—and free—starting point is to analyse what people in Singapore are actually searching for online. Tools like Google Trends give you a powerful glimpse into consumer interest before you’ve spent a single dollar.

Actionable Insight: Set the location specifically to Singapore and start entering your core product keywords, such as “organic skincare” or “handmade leather bags.” A steady or rising trend is a great initial signal that there’s sustained interest.

Next, get specific. Look at the exact phrases people are using. Do they search for “running shoes” or “trainers”? “Handbags” or “tote bags”? These little nuances are gold because they tell you precisely how to frame your product listings and marketing messages. This simple step answers the most fundamental question: are people in Singapore even looking for what I sell?

Once you’ve confirmed there’s search demand, it’s time to research the local marketplaces. Platforms like Shopee and Lazada are dominant in Singapore and provide a treasure trove of competitive intelligence.

Don’t just browse. Go deep. Start by dissecting the product assortments of the top sellers in your category.

Analysing dominant local marketplaces provides a direct window into consumer behaviour and competitive positioning. It’s the most effective way to understand what sells, at what price, and what customers truly want.

To understand the ‘why’ behind what people buy, go where Singaporeans talk about products. Local forums, niche Facebook Groups, and subreddits can offer priceless insights into what shoppers are really thinking.

Look for conversations about products like yours. What do they love? What frustrates them? What do they wish they could find? This qualitative research adds a human layer to all the data you’ve gathered.

The numbers tell a compelling story, too. Singapore’s e-commerce market is booming, hitting US$8.2 billion in 2022 with forecasts showing it’ll reach US$11 billion by 2025. A huge part of this growth comes from cross-border shopping. The demographics might surprise you: 24% of cross-border shoppers were aged 55-64, easily outpacing the 18-24 group at just 13%. You can get a deeper dive into these trends from this helpful Singapore eCommerce market guide.

The table below summarises some of the most important data points that paint a clear picture of the Singapore market.

This table summarises the crucial statistics that define the Singaporean ecommerce landscape, giving sellers a quick reference for market size, consumer behaviour, and growth potential.

| Metric | Statistic | Implication for Sellers |

|---|---|---|

| Market Size (2022) | US$8.2 billion | A substantial and active market with high spending power. |

| Projected Market Size (2025) | US$11 billion | Strong, consistent growth signals a healthy future for ecommerce. |

| Cross-Border User Penetration | 60% of online shoppers | Singaporeans are very comfortable buying from international sellers. |

| Largest Cross-Border Age Group | 55-64 years (24%) | Don’t ignore older demographics; they have significant purchasing power. |

| Smallest Cross-Border Age Group | 18-24 years (13%) | Younger audiences might require a more targeted or different approach. |

| Top Purchase Categories | Electronics, Fashion, Personal Care | High demand in these areas, but also likely high competition. |

| Preferred Payment Methods | Credit Cards, Digital Wallets | Offering diverse and modern payment options is crucial for conversion. |

These indicators highlight a mature, digitally savvy market that is very open to buying from overseas brands.

By combining search trend analysis, competitor deep-dives, and insights from online communities, you get a 360-degree view of the market. This groundwork allows you to enter Singapore not with a hopeful guess, but with a strategy built on solid evidence—dramatically increasing your odds of a successful launch.

Expanding into a new market like Singapore is a fantastic milestone, but it also brings a fresh set of operational puzzles. Winning at cross-border e-commerce requires smart solutions for the most common hurdles. If you get ahead of these challenges, you can build a resilient strategy that keeps customers happy and your back-end operations running smoothly.

There are four core pillars you absolutely need to get right: logistics, taxes, payments, and returns. Each one has its own quirks, but with the right game plan, they are all entirely manageable.

Let’s break down how to tackle them, one by one.

Getting your product from your warehouse to a customer’s doorstep in another country is the most visible—and critical—part of the cross-border experience. Who you choose to ship with directly impacts your costs, delivery speed, and ultimately, how happy your customers are. You have three main options, each with its own pros and cons.

Practical Example: If you sell high-value electronics, using a courier like DHL provides the tracking and insurance needed to protect your shipment and give customers peace of mind. For lower-cost fashion accessories, a national postal service may be sufficient to keep prices competitive.

Nothing kills a sale faster than an unexpected fee at checkout. It’s one of the biggest reasons for cart abandonment. To do well in Singapore, you have to be upfront about all costs, and that starts with understanding the local tax rules. The two key things to master are the Goods and Services Tax (GST) and the concept of ‘de minimis value'.

The de minimis value is the price threshold below which goods can be imported without any taxes. In Singapore, this is currently S$400. Any shipment valued below this amount is GST-free, which makes your products instantly more affordable for shoppers.

For any order over S$400, you’ll need to collect GST. The most customer-friendly way to handle this is to calculate and show these costs right at the checkout. This approach is known as Delivered Duty Paid (DDP). It guarantees no nasty surprises for your customer upon delivery, which goes a long way in building trust.

Hiding taxes until the final step creates friction and can lose a customer’s trust. Transparent, all-in pricing is a massive advantage in competitive cross-border markets.

How your customers pay is just as important as what they’re buying. While major credit cards are common in Singapore, a huge chunk of the population prefers to use local digital wallets and bank transfer options. If you don’t offer these, you’re practically inviting them to abandon their cart at the last second.

To solve this, explore fast and cost-effective cross border payments. Actionable Insight: Integrate payment gateways that support popular local methods like PayNow, GrabPay, or specific online banking portals. This is a clear signal to Singaporean shoppers that you understand their preferences and have made the effort to create a smooth shopping experience for them.

A simple, straightforward returns process is a massive trust-builder for international shoppers. Customers are far more willing to take a chance on a brand from overseas if they know there’s an easy way to send something back if it doesn’t fit or isn’t what they expected.

Your international returns policy needs to find the sweet spot between customer convenience and your own costs. Actionable Insight: Offer solutions like a local return address (which a 3PL partner can often manage for you) or work with a specialised returns management service. Be crystal clear about who pays for return shipping and the timeframe for refunds to manage expectations from the get-go.

Once you’ve sorted out the operational nuts and bolts, the next big question is simple: where are you actually going to sell? Picking the right sales channels is a make-or-break decision for your cross-border strategy. You really have two main paths: jumping onto established global marketplaces or building your very own direct-to-consumer (DTC) website.

Each route comes with its own set of pros and cons. The best choice for you boils down to your brand’s personality, how deep your pockets are, your team’s technical skills, and what you ultimately want to achieve in the Singapore market.

Think of platforms like Lazada, Shopee, or Amazon SG as massive, bustling shopping centres. By setting up your digital shopfront here, you immediately get your products in front of a huge, built-in audience of shoppers who are already logged in and ready to buy. It’s often the quickest way to land your first international sales.

Logistics also tend to be simpler. With the Southeast Asian logistics sector valued at a whopping USD 8.07 billion in 2024, marketplaces have this down to a science. Shopee, for example, pulls in 13.21 million monthly visits and offers integrated warehousing and delivery that makes fulfilment a breeze, especially for SMEs. You can dig into more stats on Singapore’s cross-border logistics at Statista.com.

However, this convenience isn’t free. You’ll be paying commission fees on every single sale, you’ll be up against thousands of other sellers (often in a race to the bottom on price), and you’ll have very little control over your branding or the end-to-end customer experience.

Building your own DTC site on a platform like Shopify or WooCommerce is like opening your own flagship boutique. You call all the shots. From the look and feel of your website to every touchpoint in the customer journey, it’s all you. Most importantly, you own the customer data, which lets you build real relationships and run laser-focused marketing campaigns.

While this path offers much greater long-term value and fatter profit margins (goodbye, commission fees!), it’s also a heavier lift. You’re responsible for generating every single click and visit, which means a serious investment in marketing and SEO. You also have to build trust from ground zero, without the safety net of a household marketplace name.

To help lay it all out, let’s compare the two strategies side-by-side.

Deciding between marketplaces and your own DTC site is a classic strategic trade-off. Marketplaces offer speed and a ready-made audience, while a DTC site gives you control and a direct line to your customers. This table breaks down the key factors to help you weigh your options.

| Factor | Selling on Marketplaces (e.g., Lazada, Shopee) | Selling via DTC Website (e.g., Shopify) |

|---|---|---|

| Speed to Market | Fast. You can set up a store and start selling in days, tapping into existing traffic. | Slower. Requires building the site, brand, and then driving traffic from scratch. |

| Audience Access | Instant. Access to millions of active shoppers already on the platform. | Build from Zero. You are responsible for all traffic generation through marketing. |

| Brand Control | Limited. You must operate within the marketplace’s design and user experience rules. | Total Control. Complete freedom to design your brand experience and own customer data. |

| Competition | Very High. You are listed directly beside competitors, often leading to price wars. | Controlled. You create your own environment without direct side-by-side competitors. |

| Costs | Variable. Lower upfront costs but ongoing commission fees eat into margins. | Higher Upfront. Costs for site development, marketing, and apps, but no sales commissions. |

| Customer Data | Owned by Marketplace. You have limited access to customer information for remarketing. | You Own It. Full access to data for building long-term customer relationships. |

Ultimately, there’s no single “right” answer. Your decision should align with your resources, brand vision, and how quickly you need to see results.

For many ambitious brands, the most powerful strategy is a hybrid approach. This lets you cash in on the high-volume traffic from platforms like Shopee while simultaneously building a strong, independent brand on your own Shopify store. The big catch? Operational complexity.

Imagine trying to update stock levels manually. An item sells on Lazada, and you have to scramble to update your Shopify inventory before you oversell. It quickly spirals into a nightmare of spreadsheets, stress, and human error.

This is where a centralised platform becomes your command centre, syncing your entire operation into a single dashboard.

A multi-channel management platform acts as the brain of your cross-border operation. It connects all your sales channels, ensuring that inventory, orders, and data flow seamlessly between them in real-time.

For instance, if you’re selling on both Shopify and Shopee, a system can automatically keep your inventory in sync. When an item sells on Shopee, the stock count is instantly updated on Shopify, and vice-versa. All your orders from every channel flow into one unified list for picking and packing, so you can stop logging in and out of a dozen different seller portals.

You can explore our guide on multi-channel ecommerce solutions to see how this integration works in practice. This unified approach solves the single biggest operational headache of multi-channel selling, freeing you up to scale your business efficiently.

Jumping into a new market needs a clear, organised plan. Think of this checklist as your project plan for launching in Singapore. Following these steps in order helps you cover all your bases, from legal checks to launch day, ensuring a smooth and professional entry into the market.

This roadmap is designed to prevent the common missteps that can derail a cross-border launch. Each step builds on the last, creating a solid foundation for your expansion.

Before selling a single item, you need to be absolutely sure your products are legally allowed in Singapore. Every country has its own unique regulations and import restrictions, and you have to follow them to the letter.

Actionable Insight: Verify that your products don’t fall into a restricted category. For example, certain health supplements, cosmetics, or electronic devices might require special licences or certifications from Singaporean authorities like the Health Sciences Authority (HSA). Getting this wrong can lead to your shipments being seized at the border—a costly and embarrassing mistake.

Next, get familiar with customs documentation. You’ll need to provide accurate Harmonized System (HS) codes for all your products. These codes are used by customs officials worldwide to classify goods and figure out the correct duties and taxes. Getting this right from the start saves you from expensive delays and potential fines down the road.

Localisation is so much more than just translating a few words. It’s about making your brand feel native to Singaporean shoppers. When you get this right, you build instant trust and see your conversion rates climb.

Start with the essentials:

A fully localised storefront signals to customers that you understand their market and are committed to providing a seamless shopping experience. It’s a powerful way to differentiate your brand from other international sellers.

How your customers pay is a critical piece of the puzzle. Failing to offer preferred local payment methods is one of the biggest reasons for cart abandonment in any ecommerce cross border strategy.

While credit cards are widely used in Singapore, they are definitely not the only game in town. Integrating payment gateways that support popular local methods is essential.

Practical Example: A huge chunk of online shoppers in Singapore use digital wallets like GrabPay or direct bank transfer services like PayNow. Offering these options right alongside traditional credit card payments caters to a wider audience and shows you’ve done your homework. A customer seeing their favourite payment method at checkout is much more likely to complete their purchase.

Your shipping strategy directly impacts two things: customer satisfaction and your profit margins. You absolutely need a reliable plan to get products to your customers in Singapore quickly and affordably.

Actionable Insight: Choose your shipping partner based on your product and customer needs. Will you use an international courier like DHL for speed, a national postal service for lower costs, or partner with a third-party logistics (3PL) provider that has a warehouse in the region? A good 3PL can dramatically slash shipping times and costs for your customers, creating a much better experience.

Once you’ve picked a partner, clearly define your shipping rates and delivery timelines on your website. Transparency is everything here. Be upfront about shipping costs and provide estimated delivery dates to manage customer expectations right from the start. No one likes a nasty surprise at checkout.

Excellent customer support is what builds long-term loyalty. International customers need to feel confident that they can get help if something goes wrong.

Your support plan has to account for time zone differences. Actionable Insight: Try to offer support during Singaporean business hours (SGT), even if it’s just via email or a chatbot at first. Providing support only during your home country’s business hours is a recipe for frustrated customers and long, painful delays.

Also, get ahead of common international questions. Create a detailed FAQ page that covers topics like customs fees, shipping times to Singapore, and your international returns policy. This proactive approach cuts down on support tickets and gives customers the information they need to buy with confidence.

Getting your brand launched in a new country is a huge milestone, but it’s really just the starting line. The secret to long-term success in cross-border e-commerce is about carefully measuring what’s working and strategically scaling your efforts from there.

Without the right data, you’re essentially flying blind, just guessing where to invest your precious time and money.

True growth is built on a foundation of smart business decisions, which means you have to be tracking the right numbers. This involves moving beyond your overall store metrics and slicing your data by country. Only then can you see what’s really happening on the ground in a market like Singapore.

To get a clear, honest picture of your cross-border health, you need to monitor a specific set of Key Performance Indicators (KPIs). These numbers cut through the noise and show you exactly how efficiently you’re acquiring new customers and how profitable each market truly is.

Focus your attention on these three core areas:

Looking at these figures together gives you a powerful snapshot of your business. For instance, a low CAC in Singapore is fantastic, but if it’s paired with a very low AOV, your overall profitability in that market might still be weak. Diving deeper into top ecommerce metrics and KPIs can give you a more complete framework for your analysis.

Once your data starts telling a story, you can build an actionable plan for growth. This playbook is all about making calculated moves based on solid performance, rather than expanding too quickly or in the wrong direction.

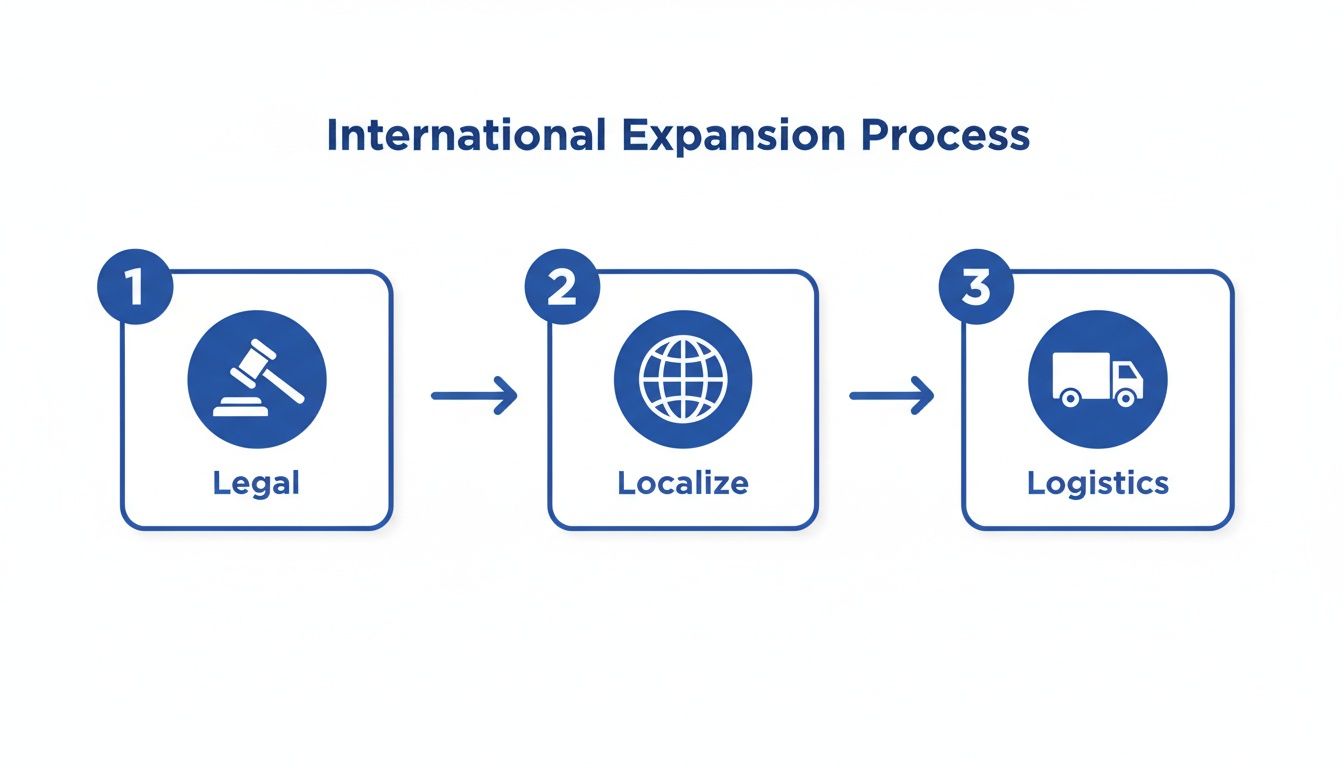

The process flow below visualises the core stages you need to nail down before you can even think about scaling.

As you can see, a successful expansion requires a methodical approach, moving from legal groundwork to localisation and finally, logistics. After you’ve built this foundation, you can confidently turn your focus to scaling up.

Here’s a practical sequence to follow:

Smart scaling is about identifying what works in a new market and doubling down on those specific channels, products, and strategies to drive profitable growth.

Going global with your brand is exciting, but it definitely brings up some questions. Here are some of the most common ones we hear from businesses taking that first big step into cross-border e-commerce.

Logistics and taxes are tricky, but the make-or-break challenge is often market and cultural localisation. Just putting your products online for a new country isn’t enough.

True success comes from really getting to know the local customers. You have to adapt your marketing, tweak your messaging, and make your brand feel like it belongs there. Practical Example: This can be anything from offering the right local payment methods to using images and models that resonate culturally. When you get localisation right, you build the trust that convinces someone to buy from a brand halfway across the world.

This is a balancing act between making customers happy and keeping your business profitable. There are a few ways to play it:

Actionable Insight: Test what works for your audience. You can start with a flat-rate or actual cost model. Then, run promotions for free shipping, or introduce a free shipping threshold (like “Free shipping on orders over S$100”) to encourage bigger purchases.

When you’re just starting out, you typically don’t need to set up a local company. You can sell directly to customers in markets like Singapore as a foreign business.

However, as your sales start to climb, it might be something to consider. Having a local entity can make tax compliance much easier, let you hire staff on the ground, and may even be necessary if you plan to store inventory in a local third-party logistics (3PL) warehouse. It’s always smart to have a chat with a legal and tax expert who knows the ins and outs of international commerce.

Ready to finally get a handle on the operational chaos of your ecommerce cross border expansion? With OneCart, you can run all your channels like Shopee, Lazada, and Shopify from one clean, powerful dashboard. No more jumping between logins or stressing about overselling, thanks to our real-time inventory sync. Learn how OneCart can unify and scale your global operations today.

Automate & Scale Your Online Business with OneCart

Start a Free TrialUsed by hundreds of merchants in Singapore & Southeast Asia