Your Guide to Cross Border E Commerce Success in Singapore 2026

Unlock global markets with this guide to cross border e commerce. Learn to master logistics, taxes, and payments for scalable growth on Shopee and Lazada.

Unlock global markets with this guide to cross border e commerce. Learn to master logistics, taxes, and payments for scalable growth on Shopee and Lazada.

Cross-border e-commerce is the process of selling your products online to customers in another country. For Singaporean brands, it’s a powerful and accessible growth strategy, opening up a global audience on platforms like Shopee, Lazada, and TikTok Shop.

Imagine you run a successful local bakery in Singapore. Your unique pandan chiffon cakes are a huge hit, and you’re selling dozens every day through your website. Cross-border e-commerce is the next step: offering delivery to customers in Johor Bahru, and then expanding your reach to Kuala Lumpur or Jakarta.

You are extending your reach beyond your immediate neighbourhood, using the internet as your global storefront.

For sellers in Singapore, this is a massive, ready-and-waiting market. Shoppers worldwide are constantly on the hunt for new products, better prices, and the quality that many Singaporean brands are known for. Selling internationally is an achievable path for small and medium businesses.

The numbers show a clear trend. In Singapore, cross-border e-commerce already makes up a staggering 55% of all online purchases. A large portion of this is the demand for products from China, which accounts for 62% of these transactions, especially in popular categories like fashion and electronics.

With Singapore’s e-commerce market projected to hit US$11 billion by 2025, going international multiplies your potential revenue. You can find more insights into Singapore’s e-commerce landscape on trade.gov.

This kind of growth demands a solid foundation. You can’t handle a surge in international orders without having your stock management and shipping workflows completely dialled in.

Selling to another country brings a new set of puzzles to solve. These are the main hurdles that any seller, especially those already managing 50 or more orders a day, needs to figure out:

The key is to see these as solvable problems. With the right strategies and technology in place, you can build a smooth process that turns international expansion from a headache into a powerful engine for your business growth.

Taking your business global requires a solid game plan for five core parts of your operations. Each one has its own unique challenges, but if you tackle them with the right strategy, they become clear, manageable steps on your path to growth.

This map breaks down the global e-commerce world, showing how sellers like you connect with customers and platforms, and the hurdles you’ll face along the way.

As you can see, success means balancing what your customers want with what platforms demand, all while navigating international challenges.

Think of customs like declaring a gift you’re sending overseas. The receiving country needs to know what’s in the box and its value to determine if any taxes are owed. For a cross-border e-commerce business, this usually involves three key costs:

For Singaporean sellers, it’s vital to understand rules like the GST on low-value imported goods. Getting these calculations right is non-negotiable, because surprise fees are a primary reason customers abandon a cart or refuse a delivery.

This all-in price—your product cost, shipping, and all taxes—is called the landed cost. It’s the final number your customer pays to get the product.

Getting your product from a Singapore warehouse to a customer’s home in another country is the physical heart of cross-border e-commerce. Your shipping method directly affects costs, delivery speed, and customer satisfaction.

There are two main ways to approach this:

For brands planning to expand through major marketplaces, you can find Amazon’s official guide on selling globally.

To help you decide which fulfilment model fits your business, let’s compare the most common international shipping strategies.

Choosing the right shipping method is a balance between cost, speed, and the level of control you want over the customer experience. This table breaks down the pros and cons of the main options.

| Strategy | Best For | Pros | Cons |

|---|---|---|---|

| Direct Shipping (In-House) | New businesses with low order volumes or those selling highly customised products. | Complete control over branding and packaging; simple to start. | Becomes very time-consuming and expensive as you scale; limited shipping options. |

| Third-Party Logistics (3PL) | Growing businesses looking to scale operations and improve delivery speed. | Access to expert logistics; cheaper shipping rates; faster delivery from local warehouses. | Less control over the final package; requires finding a trustworthy partner. |

| Dropshipping | Entrepreneurs who want to test products without investing in inventory. | No need to hold stock; low startup costs; wide product selection. | Very low profit margins; no control over quality or shipping times; high competition. |

| Marketplace Fulfilment (e.g., FBA) | Sellers who primarily use one major platform like Amazon and want to leverage its logistics network. | Fast, reliable shipping; access to marketplace perks like Prime; simplified logistics. | Strict packaging rules; high fees; inventory is tied to one platform. |

Ultimately, the best strategy depends on your product, your target market, and your growth ambitions. Many successful brands use a hybrid approach, combining different methods for different regions.

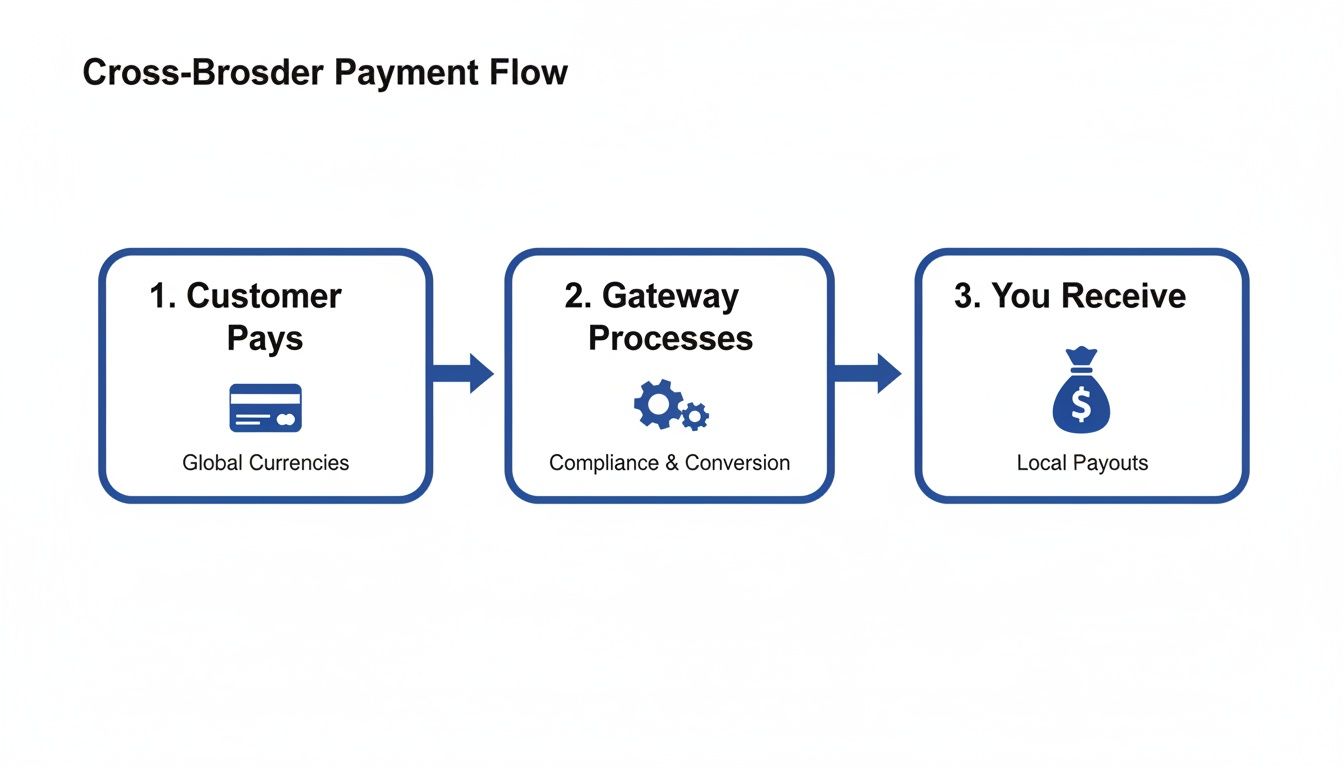

A customer in Thailand probably won’t buy from you if they can only pay in Singapore Dollars with a payment method they’ve never heard of. You have to offer familiar, local payment options to build trust and drive conversions.

Handling currency conversion is the other side of this coin. You need a way to show prices in your customer’s local currency without letting fluctuating exchange rates destroy your profit margins. Actionable Tip: Use a Shopify app that allows for local currency display, and set your product prices with a small buffer (e.g., 3-5%) to absorb minor currency fluctuations without needing to update prices daily.

International returns can be a logistical and financial challenge. The cost of shipping a product back across a border, getting it through customs again, and restocking it can erase any profit from the original sale.

Your best defence is a proactive one. Focus on preventing returns before they happen by:

Localisation is more than just translating your website. It’s about tailoring the entire customer experience to feel native in each new market. This means understanding cultural nuances, local tastes, and regional habits to connect with people.

For example, a marketing campaign pushing heavy winter coats won’t work for shoppers in tropical Southeast Asia. Product sizing also needs to be adapted—a “Medium” in one country might be a “Large” elsewhere. Practical Example: A Singaporean snack brand expanding to the Philippines could create a marketing campaign around “merienda” (afternoon snack) culture and offer a spicy flavour variant, which is popular there, instead of just promoting their original flavours.

The operational strain of this growth is real. Singapore Customs cleared three times more low-value goods in 2021 than in 2019, which led to delivery delays. However, new solutions like real-time payment links with countries like Thailand are making things smoother, catering to the 81% of consumers who now prefer e-payments.

Knowing your audience is critical when you start selling internationally. To win over shoppers in Singapore, you need to understand what they want and how they buy.

It’s easy to assume that younger, digital-native generations are driving all online sales. The reality in Singapore is quite different. The data reveals a powerful customer group that many businesses overlook.

Recent demographic shifts are reshaping e-commerce in Singapore. Of the country’s 3.51 million online shoppers, a remarkable 24% of those aged 55-64 are leading the charge. This group is the most active segment when it comes to cross-border shopping.

They significantly outpace the 13% of 18 to 24-year-olds who shop internationally. This experienced, digitally savvy demographic is now fuelling a massive 55% of all online purchases from abroad. With Singapore’s internet penetration at 96%, it’s time to adjust your strategy. You can dig deeper into these trends with insights on Singapore’s cross-border market from Statista.

The data offers a clear takeaway: if your marketing only targets Gen Z, you’re missing a large piece of the international sales pie. Your marketing, product presentation, and customer service must be designed to meet the expectations of an experienced, discerning, and financially empowered audience.

Understanding who is buying is the first step. The next is knowing what they are buying and where it’s coming from. The most popular product categories for Singaporean international shoppers consistently include:

A huge portion of these cross-border purchases originates from China, driven by competitive pricing and an enormous variety of goods. This highlights the importance of having efficient supply chains and logistics partners capable of handling shipments from major global manufacturing hubs.

Here’s how to translate these market insights into practical actions for your business, specifically for a Shopify store owner wanting to attract the 55–64 age demographic.

1. Refine Your Social Media Marketing Research shows about half of Singaporeans make purchases through social platforms like Facebook and Instagram. Create campaigns that speak to the values of mature buyers. This means highlighting product quality, durability, and excellent customer service rather than just flash sales. Actionable Tip: Use Facebook ads with clear, high-contrast images and simple text overlays. Target interests like “quality craftsmanship” or “gardening” alongside age demographics, instead of relying on trend-based interests.

2. Optimise Your Product Listings This demographic values clarity and trust. Make sure your product descriptions are detailed, your images are high-quality, and your sizing charts are easy to understand. Customer reviews and testimonials are especially powerful, so make them prominent on your product pages.

3. Simplify the Customer Experience Your website needs to be easy to navigate, with clear menus and a straightforward checkout process. Offer familiar and secure payment options. A complicated experience will quickly turn away these savvy shoppers.

By aligning your strategy with how Singapore’s international shoppers actually behave, you position your business for real, sustainable growth.

When you first started selling online, jumping between your Shopee, Lazada, and Shopify dashboards was probably manageable. But as you expand across borders and your order volume climbs, that manual process starts to break.

Time spent frantically updating stock levels, copying and pasting order details, and editing product listings one by one is time you’re not spending on strategy and growth. It’s chaotic and unsustainable.

Think of it like running a restaurant chain. You wouldn’t have each kitchen ordering its own ingredients without any central oversight. You’d have a central system managing supplies and tracking performance. For your e-commerce business, a unified commerce platform is that central system.

This centralised approach is the backbone that lets you handle more orders without your systems falling apart. To build a robust tech stack that can support global growth, it helps to explore essential e-commerce tools and see how they fit together.

The single biggest risk of selling on multiple channels is overselling—taking an order for a product you don’t actually have. This leads to cancelled orders, unhappy customers, and potential penalties from marketplaces.

A multi-channel platform eliminates this by syncing your inventory in real-time across every channel. When a product sells on Lazada Malaysia, the stock count is instantly updated on your Shopify SG store, Shopee Philippines, and everywhere else. This is a game-changer for maintaining inventory accuracy and protecting your brand’s reputation.

Imagine trying to process 100 orders a day by logging in and out of three different seller centres. It’s slow and a recipe for mistakes like shipping the wrong item. Centralisation creates massive efficiency gains.

With a unified dashboard, you can:

This consolidation transforms your fulfilment process from a manual chore into a smooth, organised workflow. It frees up your team’s time so they can focus on getting orders out the door faster and with fewer mistakes.

Updating product details across multiple platforms is another major time-sink. A simple price change means you have to log into each marketplace and make the same edit over and over.

A central platform fixes this with a “list once, sync everywhere” approach. You create or edit a product listing in one central place and then push those changes to all your connected channels simultaneously. This saves an incredible amount of time and ensures your branding and product information are consistent across your entire cross-border e-commerce footprint.

For merchants still weighing their options for a foundational platform, our detailed comparison of top e-commerce platforms in Singapore can offer some valuable direction.

You can’t make smart business decisions with fragmented data. When your sales figures are scattered across different dashboards, it’s nearly impossible to get a clear picture of your overall performance.

A unified analytics dashboard pulls all your performance data together. This single view lets you track key metrics like revenue, order volume, and profit margins across all your markets. Armed with this clear insight, you can make informed decisions about pricing strategies, inventory allocation, and marketing spend to drive real, scalable growth.

Jumping into cross-border e-commerce can feel massive, but you don’t have to do everything at once. Break the process down into a clear, step-by-step plan. This makes your global launch more manageable.

We’ve boiled down the essential strategies into a practical checklist. This approach is about building momentum, letting you learn and adapt. The goal is to start small, prove your strategy works, and then scale up with confidence.

Your first move into selling internationally should be a calculated one. It all starts with figuring out where your products will make the biggest splash and making sure your business is ready for the operational shifts ahead.

Conduct Market Research: Don’t try to conquer the world in one go. Pinpoint your top one or two target countries by looking at product demand, local competition, and cultural fit. A great place to start is your own website analytics—see which countries are already sending you traffic.

Perform a Compliance Check: Before shipping, get a clear picture of the tax and customs rules for your chosen markets. Dig into the specifics on duties, GST/VAT, and any restricted products to avoid expensive surprises at the border.

Audit Your Technology: Take an honest look at your current systems. Can they handle pricing in multiple currencies? Can they sync inventory across different regional marketplaces? Spotting these gaps now highlights where a unified platform can plug critical holes.

A successful launch is about starting with a solid foundation, being prepared to learn, and having the right tools to adapt quickly as your international sales grow.

With your research and audits done, it’s time for a controlled test launch. A pilot programme minimises risk while giving you priceless, real-world data to shape your full-scale expansion.

Plan Your Logistics: Start getting quotes from different shipping carriers and 3PL providers. Compare their rates, delivery times, and tracking capabilities to find the fulfilment strategy that gives you the best balance of cost and customer experience.

Localise a Pilot Channel: Pick just one international marketplace to start, like Shopee Malaysia. Concentrate your efforts on localising your top 10 best-selling product listings for this channel. That means translating descriptions, adjusting sizing to local standards, and setting prices in the local currency.

Launch and Measure: Go live! From here, use a centralised dashboard to keep an eye on your initial sales, customer feedback, and how your operations are holding up. The right technology partners and e-commerce enablers will give you the support you need to manage this new channel efficiently. This data is what you’ll use to fine-tune your approach before you expand any further.

Stepping into international markets naturally brings up a lot of questions. Let’s tackle some of the most common practical concerns sellers have when they start their cross-border e-commerce journey.

Two big missteps can sink your profits and reputation. The first is underestimating your total shipping costs. It’s easy to look at the base rate, but sellers often forget to factor in fuel surcharges, customs clearance fees, and final-mile delivery charges. These add up and will eat your margins.

The second major error is treating localisation as an afterthought. Just running your product descriptions through a translator isn’t enough. You have to adapt everything—sizing charts, marketing messages, and even product photos—to fit the cultural norms of your new market. Practical Example: A seller might use a direct translation of a marketing slogan that sounds clever in English but is confusing or even offensive in another language, instantly alienating potential customers.

Good international customer service boils down to being accessible and understandable. First, tackle time zone differences. Use chatbots or automated email responses to instantly acknowledge queries that come in while your team is offline. A simple “We’ve got your message and will get back to you” is much better than silence.

When it comes to language barriers, user-friendly translation tools can get your team surprisingly far. The key is to manage expectations. Clearly post your support hours in both your local time (SGT) and the customer’s time zone so they know when to expect a human response.

Yes, absolutely. Sellers in Singapore can list their products on global marketplaces like Amazon, Shopee Malaysia, or Lazada Philippines. The process involves setting up a seller account on the specific international platform and making sure you follow their rules for listing products and handling fulfilment.

This is where a unified platform becomes a game-changer. Instead of juggling your Singaporean Shopify store in one tab and your Malaysian Amazon listings in another, you can sync your inventory and process all your orders from a single dashboard. This prevents you from accidentally overselling a popular item and makes managing a multi-channel, cross-border e-commerce business feel organised and scalable.

Ready to scale your business across borders without the operational headaches? OneCart centralises your inventory, orders, and listings from Shopee, Lazada, Shopify, and more into a single powerful platform. Book a demo today and see how you can grow globally with confidence.

Automate & Scale Your Online Business with OneCart

Start a Free TrialUsed by hundreds of merchants in Singapore & Southeast Asia